Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers.

Good accounts payable turnover ratio how to#

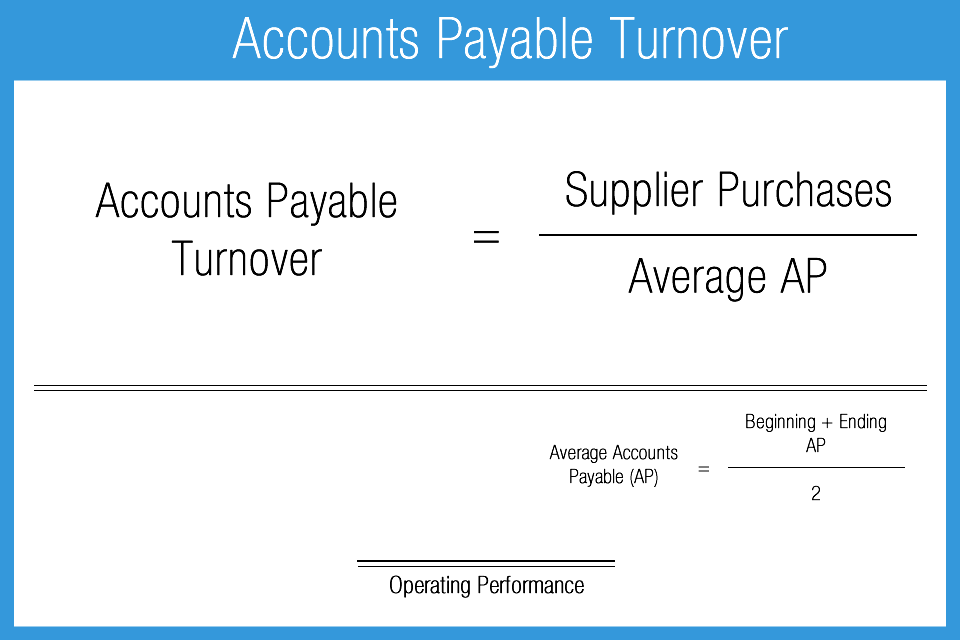

This article will deconstruct the accounts payable turnover ratio, how to calculate it — and what it means for your business. The higher the accounts payable turnover ratio, the quicker your business pays its debts. Accounts payable turnover ratio is a measure of your business’s liquidity, or ability to pay its debts. Even if your business is otherwise healthy, having a low or decreasing accounts payable turnover ratio could spell trouble for your relationship with your vendors. Your accounts payable turnover ratio tells you — and your vendors — how healthy your business is. The specific information included here are cash receipts from revenues, including interest and dividend revenue. The statement of cash flows lists all operating activities first on the report. Accountants typically list sales register an increase in accounts payable on a single line for the statement of cash flows.

When a company purchases goods on account, it does not immediately expend cash. The reason for this comes from the accounting nature of accounts payable. Where Do I Find a Company’s Accounts Payable?Ī positive figure represents an increase while a negative number indicates a decrease in the balance. Here’s a hypothetical example to demonstrate how accrued expenses and accounts payable work. Accounts payable are expenses that come due in a short period of time, usually within 12 months. Examples include purchases made from vendors on credit, subscriptions, or installment payments for services or products that haven’t been received yet. Accounts payable refers to any current liabilities incurred by companies. Most businesses prepare an accounts payable aging schedule at the end of each month. This indicates an increase in both accounts receivable and sales account.Īn accounts payable aging report looks almost like an accounts receivable aging schedule. Thus, the accounts receivable account gets debited and the sales account gets credited. Top Reasons Why Account Payables Increase or Decrease:Īccounts receivable refers to the amount that your customers owe to you for the goods and services provided to them on credit. For example, a company’s payables turnover ratio of two will be more concerning if virtually all of its competitors have a ratio of at least four. As with most financial metrics, a company’s turnover ratio is best examined relative to similar companies in its industry. If the ratio is so much higher than other companies within the same industry, it could indicate that the company is not investing in its future or using its cash properly. A limitation of the ratio could be when a company has a high turnover ratio, which would be considered as a positive development by creditors and investors. Accounts payable, often abbreviated as “payables†for short, represents invoiced bills to the company that has not been paid off. In order to project a company’s A/P balance, we need to compute its days payable outstanding (DPO) using the following equation. Our partners cannot pay us to guarantee favorable reviews of their products or services. By taking capital expenditures into account, we are using the Free Cash Flow (FCF) formula.

The offsetting effect of depreciation and amortization is capital expenditures. Like all key performance indicators, you must ensure you are comparing apples to apples before deciding whether your accounts payable turnover ratio is good or indicates trouble. Expenses must be recorded once incurred per accrual accounting standards, which means when the invoice was received, rather than when the company pays the supplier/vendor. A company’s accounts payable include any outstanding bills that need to be paid shortly. When recording a transaction, it is always important to put data in the proper column. Debits and credits in an accounting journal will always appear in columns next to one another. As a result, an increasing accounts payable turnover ratio could be an indication that the company managing its debts and cash flow effectively.ĭebits and credits must be recorded in a certain order in an accounting journal entry. An increasing ratio means the company has plenty of cash available to pay off its short-term debt in a timely manner. When the turnover ratio is increasing, the company is paying off suppliers at a faster rate than in previous periods.

0 kommentar(er)

0 kommentar(er)